Ministry advocates for tax on sugary beverages due to increasing consumption

Vietnam'sp biggest worry lately isn't North Korea or China, but the surge in the consumption of sugary drinks. From 18.5 litres in 2009 to a whopping 66.5 litres in 2023, the nation has seen a staggering increase in sugary drink consumption. That's an alarming 350% per capita increase, giving folks an average of 66 litres yearly - roughly 18g of sugar each day, or 36% of the World Health Organization's maximum suggested intake for adults.

The Issues at Hand

The Ministry of Health (MoH) is sounding the alarm, fearing the devastating consequences if no action is taken. According to MoH, around 34% of high school students consume carbonated beverages on a daily basis. Rising sugar consumption is directly linked to increased risks of obesity, diabetes, and heart disease.

To combat this worrying trend, the MoH suggests imposing a special consumption tax, backed by the World Health Organization, which asserts that such a tax is among the most effective strategies for reducing sugar consumption and preventing non-communicable diseases. The WHO recommends a tax that boosts retail prices by at least 20%.

The Proposed Tax and Its Benefits

Research from the Ha Noi University of Public Health predicts that such a tax in Vietnam could prevent 80,000 diabetes cases and save nearly VNĐ800 billion (US$30.77 million) in healthcare costs, all while lowering the rates of overweight and obese individuals by 2.1% and 1.5%, respectively.

However, some argue that the proposed 8-10% tax starting in 2027 is too tame, with delegate Lê Hoàng Anh from Gia Lai Province urging for a 10% tax from 2026, escalating to 20% by 2030, combined with an absolute tax based on sugar content, similar to Thailand's model.

Global Comparisons

The availability of sugar-sweetened beverage taxes isn't a new concept. At least 108 countries have already imposed special consumption taxes on sugary drinks, including six in Southeast Asia: Thailand, Malaysia, the Philippines, Brunei, Cambodia, and Laos. Thailand, for example, imposes a tiered excise tax on sugar-sweetened beverages, based on sugar content, with rates reaching up to 5 baht ($0.15) per liter for drinks containing more than 14 grammes of sugar per 100ml.

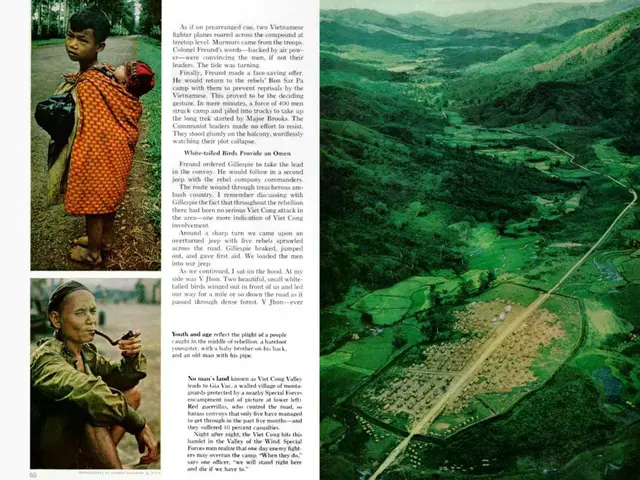

Between 2009 and 2023, sugary drink consumption quadrupled, nearly doubling in the past decade alone. Per capita consumption surged by 350 per cent, from 18.5 to 66.5 litres per year. - Photo suckhoedoisong.vn

Other countries, such as the Philippines, levy a specific excise tax, charging 6 pesos ($0.10) per liter for drinks sweetened with sugar or non-caloric sweeteners and 12 pesos per liter for those containing high-fructose corn syrup.

With the surge in sugary drink consumption and its detrimental health effects, Vietnam stands to gain much from emulating the successful strategies already implemented in countries like Thailand and the Philippines. The question is not if but when Vietnam will take action to protect its citizens' health.

- The Ministry of Health (MoH) in Vietnam is concerned about the significant increase in sugary drink consumption, which has jumped from 18.5 to 66.5 litres per year, posing potential health risks.

- The MoH is advocating for a special consumption tax, as proposed by the World Health Organization, to address this issue, with the aim of reducing sugar consumption and containing the rise of non-communicable diseases.

- Research suggests that such a tax in Vietnam could prevent thousands of diabetes cases, save millions in healthcare costs, and lower rates of overweight and obese individuals.

- However, some delegates propose a more aggressive tax schedule, urging for an immediate 10% tax, escalating to 20% by 2030, combined with a tax based on sugar content, like Thailand’s model.

- Several countries, including Thailand and the Philippines, have already implemented sugar-sweetened beverage taxes, which have proven to be effective in reducing consumption and addressing health concerns.

- In Thailand, for instance, a tiered excise tax on sugar-sweetened beverages based on sugar content is in place, with tax rates reaching up to 5 baht per liter for drinks with high sugar content.

- Additionally, the Philippines imposes an excise tax on sugary drinks, charging 6 pesos per liter for drinks sweetened with sugar or non-caloric sweeteners, and 12 pesos per liter for those containing high-fructose corn syrup.

- Given the surge in sugary drink consumption and its associated health risks, adopting successful strategies from countries like Thailand and the Philippines could benefit Vietnam's citizens' health significantly.

- The debate now revolves around when Vietnam will take action to implement policies that prioritize health-and-wellness, fitness-and-exercise, skin-care, nutrition, weight-management, cardiovascular-health, and more, in the face of increasing health concerns related to sugary drinks.